Weekly Economic Review - 11/15/20 to 11/21/20

Contributors: Kenichiro Bernier, Helen Yeung, Katelyn Cua

PDF version

Markets Overview

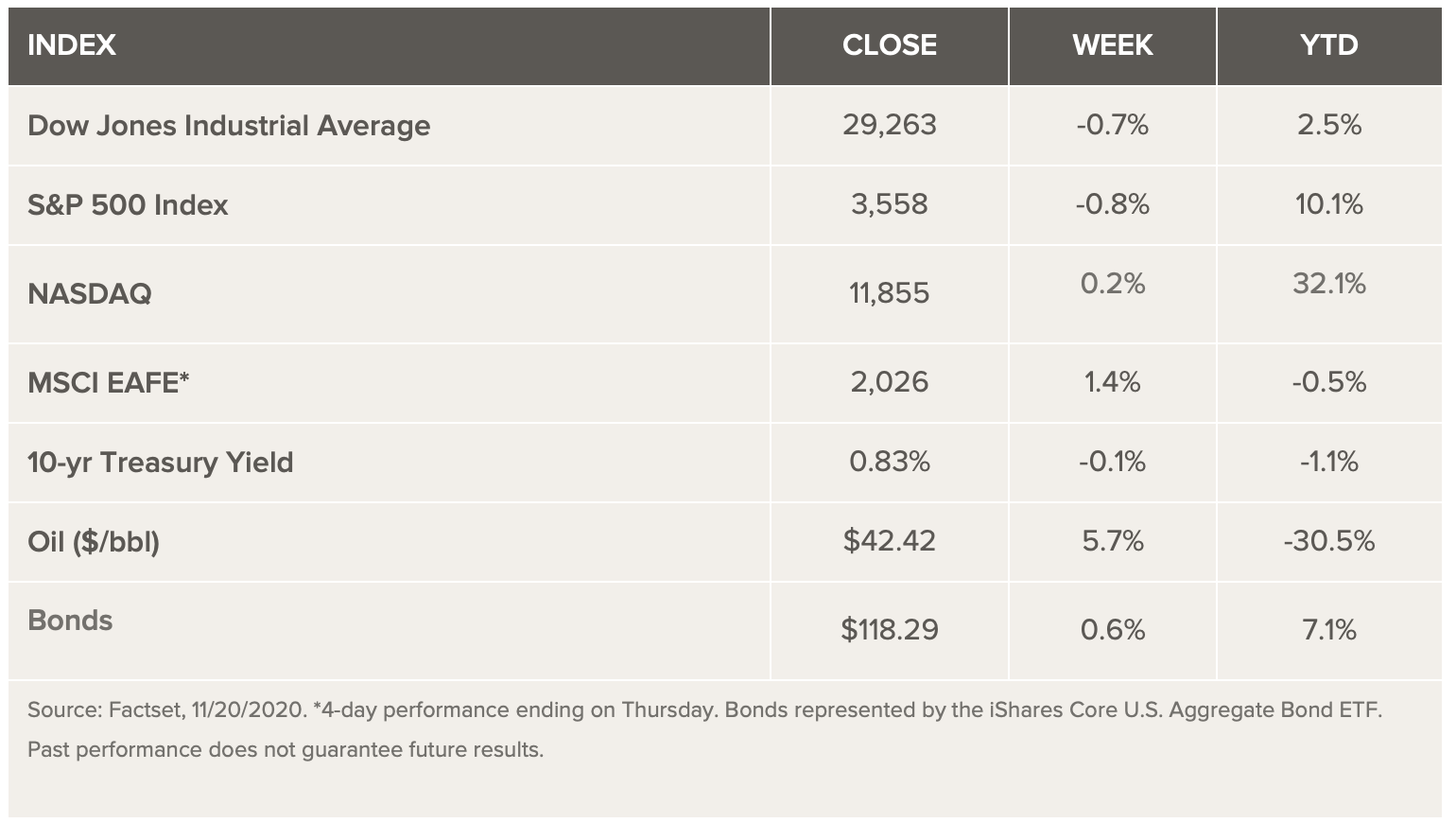

Market Summary: Following two-weeks of gains led by positive vaccine developments, US equities and government bond yields fell Friday, finishing this week in the red. Although the S&P500 has gained 5.6% since November 3rd, the index dropped 0.8% on a weekly basis, while the 10-year US Treasury notes saw its largest one-week yield decline since this August, moving down from 0.828% to 0.892%. Negative drivers for this week’s market action include a surge in virus infections across the country, stagnant US unemployment recovery, and deflated optimism regarding the expiration of emergency Federal Reserve Programs. On the positive side, Pfizer and BioNTech announced that their COVID-19 vaccine is 95% effective and that they have applied for emergency use in the US.

Jobs and the Economy: Data released this week showed an increase in initial jobless claims, pointing to a slowing economic recovery and a struggling US labor market. With cases rising and states considering reimplementing restrictions, major employers—including airlines, restaurant chains, and hotels—continue to face extreme headwinds, resulting in a significant number of layoffs and unemployment claims. In addition to these difficulties, the US Treasury stated that they would discontinue several of the Federal Reserve’s emergency programs beyond 2020. The relief provided by the Fed—such as entering the corporate credit and municipal-borrowing markets—has supplied investors with a sense of insurance and security throughout this pandemic; some are concerned this decision will add to the volatility of markets in the near future.

Market Rotation: A defining theme that has emerged in markets over the last couple of weeks is a shift in leadership across asset classes, sectors, and investment styles (Edward Jones). With this so-called market rotation in play, cyclical sectors, such as energy and financials, have recently been outperforming growth stocks that have benefited from the pandemic, including technology and communication services. Additionally, US large-cap stocks have lagged behind small-cap and international investments. Along with sector and asset class rotations, investment styles have also been shifting, favoring value over growth investments. Positive vaccine news and expectations for a durable economic recovery through 2021 primarily explain why markets have been experiencing these rotations over the past few weeks. While these rotations have more of a mid-to-long-term view, short-term uncertainties and risks remain, for reasons outlined above. Accordingly, investors should not expect consistency with these rotations and should appropriately diversify their portfolios to avoid overexposure to a specific trend or development.

Inudstry Focus: Commodities

Overview

A commodity market is one that trades in the primary economic sector, such as fruit and

sugar, rather than manufactured products. Hard commodities include mined products, such as

gold and oil.

Conventionally, the U.S. dollar’s strength is seen with an inverse relationship to the price of imports, which include many commodities. Commodities such as precious metals, agricultural goods, oil, and gas are often used as a portfolio diversifier to hedge against inflation. While there could be a negative correlation between other assets’ return and that of commodities, commodities tend to respond to changes in the dollar's relative strength in international markets rather than domestic inflation pressures.

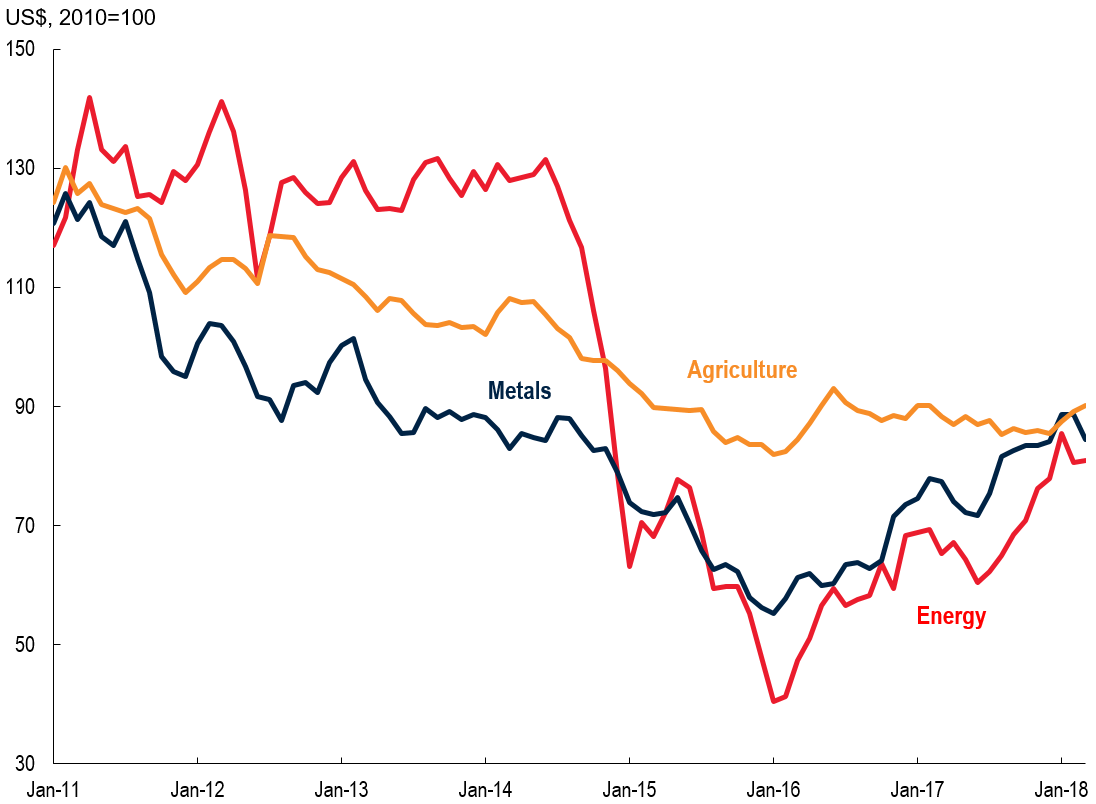

The commodities market experienced a huge shock in March 2020, when the coronavirus loomed. While energy prices plummeted, the agricultural sector remained relatively resilient. Observing the Bloomberg Commodity Index, the commodities have been on a decline, and there have been voices arguing whether commodities are experiencing cyclical weakness or secular decline. Nevertheless, the market has been on recovery since the downturn during March.

Agricultural Commodities

Global trade in food and agricultural products doubled in the past two decades, amounting to

USD 1.5 trillion in 2018, according to a report by The State of Agricultural Commodity

Markets, 2020 (SOCO 2020). In particular, about one-third of global agricultural and food

exports are traded within a global value chain, and cross borders at least twice.

Agricultural commodities such as corn, soybeans, and wheat are crucial to the food supply, which built a giant global commodities market to buy and sell them. For instance, the S&P GSCI Agriculture index has been on a rise recently.

Individual agricultural commodities are susceptive to high volatility correlated with weather, season, population, etc. Thus, one common practice is to invest in an agriculture-focused exchange-traded fund (ETF) for diversification.

Transaction Highlights

BP agrees to sell its London headquarters for £250M (~$332M). (November 20, 1:25PM

ET)

This is part of the company’s plan to sell $25B worth of its assets by 2025. It also plans

to lease its London office back from LifeStyle International, a Hong Kong-based property

investment company, for 2 years. BP is about halfway to its asset disposition goal, which it

set as part of its shift toward low carbon energy investments.

Accenture acquires Arca, a Spanish engineering services company that focuses on network

operations and business services, in order to reinforce its 5G network capabilities.

(November 20, 6AM ET)

While the terms of the transaction were not publicized, Arca’s employees will be joining ACN

in Spain.

Verizon Media is selling HuffPost to Buzzfeed as part of a bigger stock deal. (November

19, 1:11PM)

As part of this transaction, Verizon Media will receive a minority stake from Buzzfeed

through the transaction, and Buzzfeed will receive some cash in return. Both companies will

also be able to coordinate content on each other’s platforms and seek joint advertising

ventures. Jonah Peretti, Buzzfeed’s founder and CEO, will run the combined company. Buzzfeed

will be in charge of finding the new editor in chief of HuffPost.

Longview SPAC will merge with Butterfly Network in a $1.5B deal. (November 20,

7:31AM)

Butterfly Network is a digital health company that aims to improve the quality and

affordability of ultrasound imaging. After the closing of the deal, the combined company

will have around $584M in cash. 100% of the equity of existing Butterfly Network investors

will convert into shares of the combined company. No selling shareholders will occur in the

transaction. Longview and its affiliates will own 7.6% of the combined company's outstanding

shares at closing. Leading institutional investors have anchored a $175M PIPE (private

investment in public equity) at $10 per share. Upon closing, which is projected for the end

of Q1 2021, the combined company's class A common stock will be traded on the NYSE under the

symbol "BFLY."

Nasdaq to buy Verafin for $2.75B (November 19, 7:16AM)

Nasdaq did this to integrate Verafin’s anti-money laundering and fraud platform to its own

established regulatory technology business. Nasdaq predicts that the transaction will

increase revenue contribution from Market Technology and Investment Intelligence segment to

47% of total Nasdaq net revenue pro forma for Q3 2020 from 44%. It also expects the deal to

accelerate organic revenue growth outlook within its Solutions Segments to 6-9% vs. 5-7%

previously. The deal is expected to close in Q1 2021.